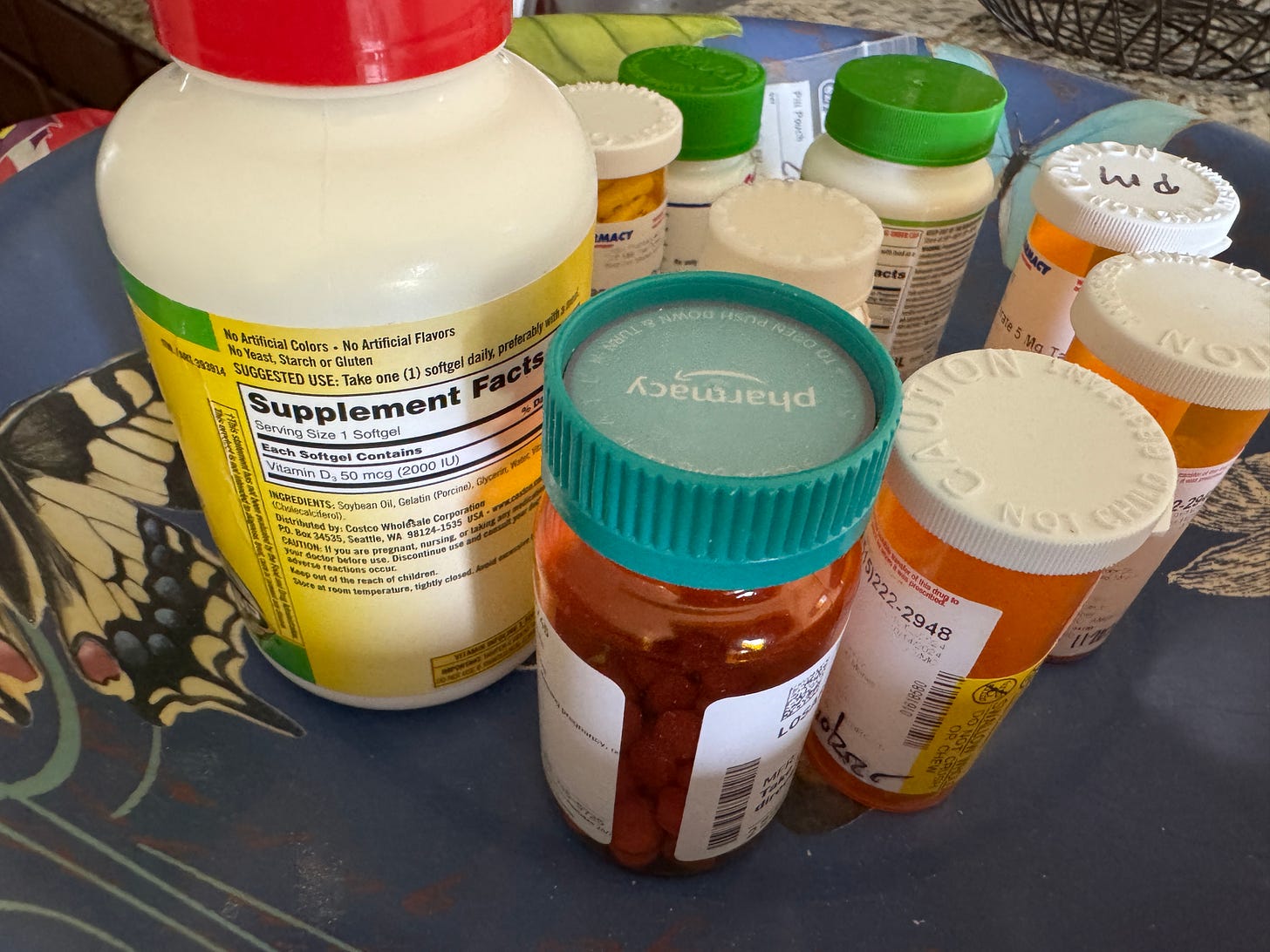

A collection of prescription and OTC medication bottles is a realty facing many in our world today. Those with the luck to age to advanced years often find themselves in a world of polypharmacy and specialists who prescribe regimens and medications to treat the multitude of ailments and symptoms.

It doesn’t take much to imagine when unintended mix-ups, mixtures, and simple side effects occur. The patient returns to their physician(s) for an alternative, one prescription is replaced with another, and the cycle begins anew.

It was one such encounter that led to the creation of a remarkably successful technology company in the hands of a pharmacist. This is his story.

The pharmacist

Pharmacists are a critical participant in delivering patient care. Though we simply see busy staff when lined up to obtain a new prescription or to simply pick up a refill, the humans behind the counter are engaged in a tightly choreographed process to review and receive physician orders, manage inventory on-hand, add a prescription to the patient’s electronic record, review potential interactions between a new and existing medications, receive approval for and/or offer alternatives, consult with the patient or caregiver, answer inbound phone calls from patients, offer and deliver vaccinations, direct customers to over the counter (OTC) medications elsewhere in the store, and listen.

That word - listen - the human connection between a trained caregiver and the one seeking care is often a critical step in the care cycle.

A personal encounter

Tom Halterman, a trained and practitioning pharmacist was visiting his mother one day in 1998 and observed her nagging cough and presence of cough medicine. Tuned to observe such anomalies he inquired about a newly prescribed medicine, called her physician on her behalf, and the physician, almost matter-of-factly, switched the prescription to an alternative. The cough disappeared.

I was reminded of the exact scenario where I was once prescribed a blood pressure medication. A dry, nagging cough appeared shortly thereafter as soon as I’d lay my head down on the pillow. Never connecting the prescription to the cough’s arrival, I only told my own doctor about it at the next appointment. Again, matter-of-factly, she instantly changed it to an alternative and the cough disappeared overnight.

Tom would go on with guiding his mother with another similar incident with muscle distress when his mother exclaimed

you shouldn’t have to have a son who is a pharmacist to get such care

The epiphany

Each new venture has a spark and mom’s exclamation in 1998 was the spark that led to a new company, Outcomes Incorporated. The company was registered in 1999 with sweat equity and seed funds raised through personal relationship from pharmacist and non-pharmacist friends. Tom had just answered his calling to be a caregiver and began building.

Their first customers were self-insured employers in the state who had employees with chronic diseases like asthma, diabetes, hypertension and others largely controlled by medication. These self-insured employers were keen on reducing costs commonly associated with patients with multiple maintenance medications and chronic health conditions. The company began to grow as did relationships with pharmacy chains wanting to be more than robotic pill dispensers.

A second spark - new regulation

Although incumbent businesses usually resist government intervention in business, new regulations often give birth to entrepreneurial opportunities. Those opportunities can be significant when they appear amongst the three rails of American politics - Social Security, Medicare and Medicaid. Medicare, of course, is the program that serves as the insurer for Americans over 65. Medicaid, on the other hand, is a program that enables health insurance for uninsured children and others without means or access to health insurance.

The Medicare modernization act of 2004 had also created a new drug benefit for seniors, commonly known as Medicare Part D, and required a public-private partnership to bring its value to members. The designers of the Part D knew that simply providing access to medications with aggressively negotiated drug prices wasn’t enough. Arming people with chemicals could have worse outcomes for the patients and spiral the program’s costs.

Outcomes’ was poised to be a perfect conduit of intelligence in prescription delivery.

An early relationship had also developed between Outcomes and an executive at the pharmacy chain Eckard. The State of Florida had recently launched a Quality Related Events project within its Medicaid program and needed Outcomes’ infrastructure. A successful pilot allowed Outcomes to expand first to four counties, then eight and finally statewide.

This infrastructure had been perfected since 1999 and telling America about this skill became crucial. Tom and a handful of staff members expanded outreach via industry conferences, speaking circuits, and publications to deliver Medication Therapy Management - a core regulatory tenet of Medicare Part D.

Hard work on part of the company found themselves on insurer radars who began actively pursuing the company. The opportunity to scale up was now at hand.

How it worked

This was the age of Internet software, a few years prior to mobile technology or the ACA mandated electronic health records. Outcomes primary product was a clinical engine which received data about prescriptions from insurers and searched for gaps and interactions. These gaps were fed back to the pharmacies to alert the pharmacist through a precursor to today’s software agents.

The product had been perfected by hand. The team had contracted with health insurance companies to consult with patients with complex medication needs. Specially trained pharmacists used prescription and medical history to create a recommended medication therapy which avoided duplications, generated cost savings, identified potential drug interactions and alternative medication.

"The insurance companies pay for this service because it results in higher quality health care," Halterman said.

Health insurers wanted this to avoid complex and expensive complications that occur through medication interactions. Pharmacists needed such an agent as they were often the first line of defense, providing critical guidance to their patients in their greatest time of need. Physicians benefited from fewer patient call-ins about newly developed symptoms.

In the time before he had encountered his mom’s nagging cough from a new prescription, Tom had been disenfranchised by the pharmacy model that employed him. He had been robotically filling prescriptions with little time to be the caregiver he had trained to become. The pharmacy, itself swamped with orders, had little time to dedicate to listening, guiding, observing, or applying their knowledge to potential negative outcomes.

Outcomes provided the automated means to assist pharmacists where intervention was necessary. Participating pharmacists willing to receive and act upon Outcomes’ intelligence could meaningfully impact patient outcomes. Health insurers, benefiting from this higher level of care, were willing to compensate pharmacists for it.

With a win-win-win in place for patients, pharmacists, and insurers, adoption and scale began to accelerate.

The earliest customers

Pharmacies were transitioning quickly from the independent neighborhood pharmacies to chains. A rapid expansion of pharmacies within grocery and pharmacy chains in recent years was underway across the country. Patients were increasingly picking up their prescription medication while shopping for groceries or sundries and the independent pharmacy business was looking for a solution.

Independent pharmacies such as Medicap became the earliest adopters of Outcomes technology and quickly benefited from the new source of reimbursement from health insurers. It further allowed their pharmacists to return to fulfilling their original role of the caregiver, extending the model of the independent pharmacist further.

Scale

The late 2000s were a period of increased conversation about healthcare in America. President Obama had run on a platform of healthcare, Medicare Part D was now firmly a part of senior care, more states provided Medicaid to those without access to healthcare. Outcomes was in the midst of this transformation, transforming its small part to a significant role.

As the first decade of the 2000s barreled toward its end and despite the financial crises playing across the markets, Walgreens, Walmart, Kroger, CVS and other pharmacies came on board the Outcomes clinical engine and added market-owning fuel to the company. Naturally, of course, so did attention from private equity with ready capital to deploy at a fast-growing company.

Tom wasn’t one to ignore these advances but wasn’t actively seeking them out either. A call from Optum around Thanksgiving 2014, however, intrigued him. This wasn’t just ready private equity but a strategic buyer with interest. He began to listen closely to Optum and other strategic potentials.

Yet, he waited.

Why not just sell?

For companies that identify themselves as B2B (business to business) software, an acquisition by a large strategic is an optimal outcome. It helps the buyer gain scale above competitors so is inclined to pay more for the acquisition. The seller knows that its software will continue to persist in the market and, additionally, makes a significant profit for themselves and their employees’ lives.

Outcomes was more than a B2B enterprise. It was a B2b2B (small b important). It was the small b sitting between the two big Bs - insurers and retail pharmacies. It provided an exceedingly valuable service to the two ends and thus was valuable to both. However, if it aligned itself with one insurer through a sale (e.g. United Healthcare) then the other insurers would be loath to give their competitor revenue. A simple strategic exit wasn’t going to be sufficient. An even larger B was needed.

Creating a strategic sell

Tom and team had built relationships over the previous decade with many and one rose to the top. Cardinal Health, a Fortune 20 company was sizeable enough to want a company in its portfolio, capable enough to expand to all insurers and pharmacies, and was comfortable in its own skin to allow the software company to independently exist in West Des Moines, away from its own headquarters.

Choosing to avoid traditional investment banking on the coasts to market their company, Tom and team leaned into local expertise in JD Geneser at LWBJ Financial (now UHY-US) who guided the diligence and acquisition.

Serendipitously, the acquisition was completed on Tom’s 50th birthday in 2015.

It was time to deliver the promised outcomes for patients nationwide, and in a corporate environment Tom had desired for his team. He was subject to the corporate parent’s employment agreement, requiring him to remain at Cardinal for two years. In a testament to Cardinal Health’s corporate governance and strong internal leadership, he would stay for six, helping the company he had started in response to his mother’s comment, grow and expand even further.

As regular readers of these stories will recall from Jay Devers’ story about Lighthouse Communications, parent companies sometimes deploy the CEOs of their acquired companies to identify, acquire, and nurture future acquisitions and Cardinal was no different. Tom would go on to acquire four additional companies, including their largest competitor. None of the acquisitions were buy-to-kill rather integrate and expand. They acquired another Iowa pharmacy success story, Telepharm, in 2016 and another, Mirixa, in 2019 to integrate into OutcomesMTM.

Continued growth and expansion

The three-person company of 1999 had grown to nearly 70 employees at the time of its acquisition by Cardinal Health. It continued to expand until Cardinal Health spun off Outcomes to Blackrock. Blackrock merged the Outcomes technology and team with another portfolio company and nearly 500 employees now deliver close to a billion in revenue to their parent.

Early in his entrepreneurial journey, Tom had worked with Mike Colwell of the Greater Des Moines partnership to identify opportunities for growth and scale. Mike had guided the company toward broader dreams, greater scale, and automation. He had also guided the founders to obtain education from statewide resources to fill in the gaps in their own business acumen. It is gratifying to see Tom paying that very knowledge forward to entrepreneurs in his portfolio and others who seek counsel.

Tom continues his entrepreneurial streak through angel investing, consulting and advisory. He can be found studying startups from myriad industries who present to Plains Angels, peppering them with insightful questions regardless of their industry. He remains a student of startups and actively works with those in his portfolio and beyond. He participates in Vistage Network of CEOs and businessowners who provide guidance and leadership to those in earlier stages of their entrepreneurial journey - and will begin teaching an Entrepreneurship course at the University of Iowa this fall.

What happened with the earliest investors?

There is an adage in the startup investment ecosphere - that the earliest money comes from the 3Fs - friends, families, and fools. These are individuals who trust the wide-eyed entrepreneur and their ideas without necessarily expecting a return. Tom’s 3Fs were a network of pharmacists, owners of independent pharmacies around Iowa. These were patient capital, willing to wait for a return should it ever come but didn’t force Tom’s hand or wait for a buck.

These pharmacists had resonated with Tom’s desire to be caregivers and not simply or robotically fill prescriptions. They had added services such as vaccinations to compensate for revenue and were ready for disruption. Some independent pharmacies would eventually close in underpopulated areas due to lack of sufficient revenue. Large pharmacy chains buckled under competitive pressure from larger retail pharmacies or online order fulfillment.

That patient capital from one of the earliest pharmacists? The $10,000 seed capital invested in the earliest stage of Outcomes resulted in a $1,500,000 payout. A 150x return. Not much of a fool, huh?

Sources

Interview with Tom Halterman, Thursday May 15, 2025

Greater Des Moines Partnership blog, November 2009

I am a proud member of the Iowa Writers Collaborative and the Iowa Startup Collective. Each writer is independent and publishes via Substack across Iowa.

Very interesting story! I didn’t know about this company.

Great story!